Real estate, stocks, crypto-currencies: Where to invest in 2024?

Real estate, stocks, crypto-currencies: Where to invest in 2024?

Introduction

In an ever-changing financial landscape, choosing the right investment may seem complicated. Whether you’re considering real estate, stocks or crypto-currencies, each option comes with its own unique set of features, pros and cons. In this article, we provide a comparative analysis to help you decide, addressing crucial aspects such as risk, volatility, accessibility and profitability.

Risk and return relation

The risk/return dynamic is a pillar of finance, illustrating the correlation between the risk inherent to an investment and the potential returns it can generate. Risk and return go hand in hand, risk being the flipside of the coin. In essence, the higher the returns an investment promises, the greater the associated risk.

Risk

In finance, risk refers to the uncertainty or variability of returns of an investment. It can be measured in a number of ways, including price volatility, the probability of capital loss, or other indicators linked to the financial performance.

Performance

Performance represents the gain or loss generated by an investment over a given period, often expressed as a percentage. Naturally, investors seek compensation via a higher return for the risks incurred, which means that riskier assets must offer attractive earnings prospects.

Swiss real estate: A stable, diversified and profitable investment

Switzerland stands out for its remarkable stability in a tumultuous global economic environment. The Swiss Confederation has not been spared by the rise in consumer prices in 2022. Not to mention the Swiss National Bank’s (SNB) first rate hike since 2007, and the tightening of mortgage lending conditions.

However, unlike the rest of Europe or the United States, “neither the return of inflation in 2022 nor the rise in interest rates have proved excessively high in our country“, analyzes Credit Suisse in its real estate market study published in 2023. If the current period is less “dreamlike” than in the past, real estate remains no less attractive as a means of diversifying and growing your wealth.

Swiss real estate: a resilient, buoyant market

Despite a slower transaction pace in 2023, residential property prices held steady. In fact, they rose further, with the Swiss Federal Statistical Office recording an average annual increase of 2.2% for property prices over the year. In addition, excess demand on the housing market persists, fuelled by high immigration and a decline in construction activity. This dynamic is helping to support prices, particularly in the new-build sector.

These are all signs of a robust, healthy market! The Swiss banks surveyed for the EY 2024 banks barometer share this opinion, and “remain very confident about the resilience of the real estate market“. All the more so as, with mortgage rates expected to decrease as early as June 2024, real estate investment is likely to pick up again.

Real estate, an ideal diversification tool

Diversification is the golden rule of an effective investment strategy. It involves varying the types of assets in which you invest. The aim? Not to put all your eggs in one basket, so as to dilute risk while maximizing your chances of making a profitable investment. Thanks to its wide range of investment options, real estate alone makes it possible to build up a varied, tailor-made, secure and long-lasting portfolio.

Moreover, real estate is an acyclical asset, as it is relatively resilient to economic fluctuations, mainly due to the constant demand for housing, a basic need. Its tangible nature and the slower buying and selling process contribute to its low volatility compared to other financial investments. In addition, the ability of properties to generate a steady stream of rental income, even in times of recession, combined with their low link to stock markets, makes them an excellent diversification tool for investment portfolios, mitigating the impact of economic cycles.

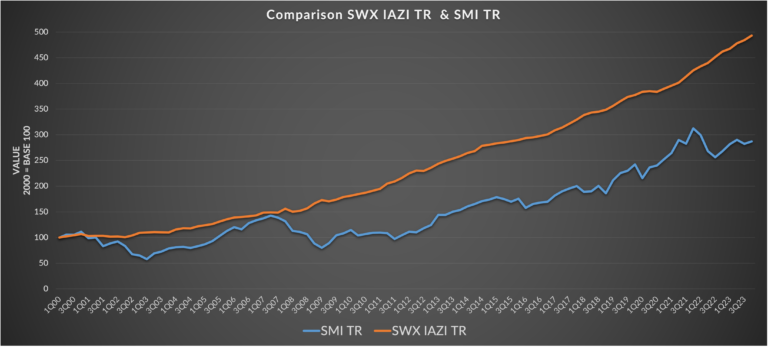

This combination of recurring income and long-term appreciation has enabled Swiss investment properties to outperform the equity market over the past twenty years, while demonstrating a significantly reduced level of volatility. This observation is supported by the comparative analysis between the SWX IAZI Investment Real Estate Performance Index (SWX IAZI TR), which measures the performance of yield properties, and the SMI TR, which measures the performance of Swiss equities, thus demonstrating the attractiveness and resilience of the Swiss real estate sector in the face of stock market fluctuations.

Finally, real estate – whether a house, an apartment or a parking space – has the advantage of being tangible. It gives you the possibility of mobilizing funds in the event of a crisis, and guarantees a degree of protection against inflation, as the UBS bank points out.

Buy-to-let, investment in co-ownership, crowdlending: An attractive profitability

There are a number of different ways to invest in Swiss real estate, starting with the best-known: buy-to-let investment, which involves buying a property to rent it out and collect a rental income. This is a solution that has proved historically profitable, providing a stable, regular income. However, there is a hitch: its accessibility is limited. The amount of equity required to acquire a property in Switzerland is an insurmountable barrier for many potential investors.

Investment in Swiss real estate with CHF 10,000

Rest assured, there are now alternatives to buy-to-let! Investment in co-ownership is one of them. With this solution proposed by Foxstone, you acquire an existing, already-rented investment property alongside other investors. The benefits: steady income from rents, simplified management, dilution of vacancy risk spread over several tenants, and potential for long-term capital gains.

Real estate crowdlending is another option for investing in Swiss real estate. With this type of investment, you grant a loan to a developer over a period of 1 to 3 years, earn fixed interest and get your capital back when the loan matures! So you have clarity about the return and duration of your investment from the outset. The entry ticket starts at CHF 10,000.

If you are planning to build your financial future and prepare for retirement, there’s nothing like investing in Swiss real estate! With its excellent long-term appreciation potential, real estate is the perfect way to build a solid family wealth and generate an ongoing additional income.

Limited liquidity

Real estate certainly has its advantages, but it doesn’t have all of them. Its main drawback is liquidity. An asset’s liquidity refers to its ability to be quickly converted into cash without suffering significant losses in value. This characteristic is often seen as a major asset, as it confers valuable flexibility on investors. A liquid asset makes it possible to react efficiently to market changes, to exploit new opportunities, or to meet urgent financial needs.

Real estate is less “liquid” than other investments. Indeed, selling a property takes longer than parting with shares or cryptocurrencies.

Investing in stock markets: Liquid assets with fluctuating values

A stock is a share in the capital of a company. Owning shares enables investors to become shareholders and receive dividends on the company’s profits, as well as participating in its increase in value.

Stocks trade easily and securely

Investing in listed stocks offers a number of advantages. Such assets generally provide excellent liquidity, making it possible to buy or sell them quickly depending on market opportunities.

Another advantage: stock markets provide a strict regulatory framework for trading shares. This regulation guarantees the transparency and security of transactions, and maintains the confidence of investors in the system. Supervisory bodies monitor compliance with the rules to ensure market integrity. In Switzerland, this role is played by the Swiss Financial Market Supervisory Authority (FINMA).

A diversified and potentially profitable investment

Stocks can be a highly profitable investment. Indeed, you can realize potentially significant capital gains as companies prosper. The shares of successful companies can generate attractive returns, making stock markets a breeding ground for capital growth.

Stock markets also give you the opportunity to invest your money in a wide variety of areas. This diversification is crucial to mitigate the risks associated with sector-specific volatility.

Complete exposure to market fluctuations

Unfortunately, this liquidity comes with a major drawback: stocks are sensitive to fluctuations in the financial markets, and price swings can be as rapid as they are dramatic! This creates a dynamic investment environment, but considerably accentuates the risk inherent in buying stocks.

Indeed, the instability of these assets is closely linked to the global economic context and the financial health of companies. Investors need to be aware of these factors, which are likely to evolve substantially and unpredictably. In-depth analysis of financial reports, economic outlooks and sector trends is essential to anticipate market movements.

Cryptocurrencies, an investment with high potential for profitability but extreme volatility

While the profitability potential of crypto-currencies is high, their extreme volatility calls for caution. There’s no security or stability here: the terrain is particularly unpredictable!

What are crypto-currencies?

Crypto-currencies, or crypto-assets, are virtual currencies that use encryption technology to guarantee the security of the transactions in which they are used. Banks are not involved in this decentralized system, which is based on the exploitation of the blockchain system.

Bitcoin, launched in 2009, marked the beginning of the digital assets revolution, and was followed by multiple digital currencies, including Ether, Ripple and Litecoin. According to the Banque de France, by mid-2023 there were over 25,000 crypto assets across the planet.

How does one go about making a crypto-investment? Mainly through specialized trading platforms. Investors can purchase these assets in exchange for fiat currencies or other cryptocurrencies, store them in virtual wallets, and expect their value to increase over time.

Two-edged crypto assets: A highly unpredictable and risky investment

Crucial information to bear in mind about crypto-currencies: they are, in essence, incredibly volatile. A characteristic which, coupled with the speculative nature of virtual currencies, offers considerable potential for profitability. But it also exposes investors to sudden and severe price fluctuations, which can result in heavy losses.

In addition to being a risky investment, crypto-currencies require a thorough understanding of how they work. The underlying technology, the blockchain, needs to be understood, as do the factors that influence prices.

Finally, unlike traditional financial markets, crypto-currencies evolve within a highly unregulated space. This lack of government or institutional oversight increases the risk of scams and fraud.

What to invest in in 2024? A choice to be made according to your investor profile

So, which investment should you opt for? Ultimately, the choice between real estate, equities and cryptocurrencies will largely depend on your investor profile, which can be established by considering a number of factors:

- Financial objectives: What do you want to achieve with your investments? Whether it’s for your children’s education, your retirement or the building up of capital, clearly defining your objectives will help you make the right choices.

- Tolerance to risk: In the case of an investment, risk implies the possibility of incurring irrecoverable financial losses. That’s why it’s more accurate to speak of tolerance to loss, which can be summed up in one question: Would you be able to sleep just as well if the value of your assets fell by 50%? Assess your ability to cope with fluctuations in the value of your portfolio, and opt for investments that match your comfort level.

- Investment horizon: The time horizon for your investments plays a crucial role in their choice. The longer it is, the more you can consider volatile investments with high return potential, as you will have the necessary time to see the value of your portfolio recover in the event of a loss.Caution: It’s important to be clear about your financial situation and not to invest money you may need in the near future.

- Financial knowledge: Be honest about your level of expertise and choose investments you can understand.

Depending on your risk tolerance and return expectations, your investor profile will fall into one of three categories:

- Conservative: Prudence dictates your approach to risk, with a marked preference for safeguarding your capital, you prefer stability to adventure. Major market turbulence is not for you. With this in mind, Swiss real estate is the ideal haven, providing you with security and peace of mind. It’s a wise decision to limit your exposure to equities and other more volatile investment vehicles, devoting only a small portion of your portfolio to them.

- Moderate: Taking an intermediate stance, you’re looking for a middle ground between growing your capital and protecting it. This means accepting a certain degree of risk, notably through investments in stocks, while seeking to temper the effects by carefully diversifying your portfolio, including assets renowned for their stability, such as real estate. This strategy aims to moderate the overall risk of your portfolio.

- Dynamic: With a high tolerance for risk, you’re ready to navigate rougher waters, attracted by the prospect of high returns. As such, you demonstrate a willingness to commit a significant portion of your savings to high-volatility assets, such as cryptocurrencies and equities, accepting marked fluctuations in the value of your portfolio as the price to pay for superior earning potential.

Conclusion

In 2024, with the range of investment options available, the key is to find the right balance for your investor profile. Swiss real estate stands out for its stability, offering a safe option for those who prefer capital preservation. Stock markets promise higher potential returns, but with volatility to take into account. Crypto-currencies, meanwhile, are attractive for their high potential gains, provided you accept extreme volatility.

Whether you’re looking for safety, growth or boldness, diversification and a deep understanding of each asset class are essential. By staying aligned with your investment principles, you’ll be better equipped to navigate the financial landscape of 2024 and seize the opportunities that lie ahead.