Value-added investment

In a previous article, we identified three types of investment in investment properties based on their characteristics. With the publication of our first value-added investment opportunity, we take a closer look at this strategy using a concrete example.

Characteristics of a value-added investment

Value-added investing is a process of actively managing a property where value can be created through works or improvements while accepting a moderate remuneration prior to the creation of this added value.

The properties sought are those with low rents compared to the market and which require a new round of renovations, due to technical obsolescence or maintenance items that have been ignored or neglected, or where possible improvements have been identified.

The work carried out increases the net income of the property through an increase in rent, within the framework allowed by law, and a reduction in operating costs. This increase in income in turn contributes to an increase in the market value of the property, as the value of a yielding property is calculated according to the income it generates. Thus, works have the double advantage of increasing income as well as the value of the property.

There are three types of work that generally increase the value of a property:

- technical or aesthetic renovations

- work to improve the energy performance of the building,

- work to extend or change the use of the building.

In the long term, this type of building can generate a higher return than new buildings. This is because new buildings have very limited scope for improvement and their rents, which are already in the upper end of the market, cannot be increased.

Case study: Building in Bex (VD)

Let us take the example of the building in Bex currently open for subscription.

It is a residential building with two four-storey blocks built in 1971. It consists of twelve 4.5-room flats, one of which was completely renovated in 2021. It is located in a quiet residential area, close to all amenities and major roads.

Foxstone has selected this building for the following reasons:

- The purchase price of CHF 2’950’000 is competitive.

- The flats are rented below market rents in the region. As an example, a 4.5 room apartment is rented for less than CHF 800 while identical flats in the region are rented for around CHF 1’200.

- Technical improvements and renovations, which will create value, have been clearly identified and budgeted for.

An amount of CHF 1,432,300 has been budgeted and included in the financial plan in order to carry out work as soon as the building is acquired and as tenants rotate. This work, entirely managed by Foxstone, will be carried out in three stages:

Work amounting to CHF 335,700 will be carried out after the acquisition of the building and will be financed by an initial payment of CHF 479,800 into the renovation fund account. The aim is to make the building attractive again. They will be of the following types:

- energy, with the replacement of the oil-fired boiler in favour of renewable energy (heat pumps and solar panels on the roof) and the renovation of the insulation and waterproofing of the roof, and

- aesthetics, with the cleaning and painting of the façade in a more modern colour.

As the improvement of the energy performance of the buildings is part of the Confederation’s 2050 energy strategy, part of this work may be subsidised for an estimated amount of between CHF 21,000 and CHF 33,000.

1.Refurbishment of the flats according to the rotation of tenants

Eleven of the twelve flats require renovation work for a total amount of CHF 551,500, which will come from the renovation fund. These renovations will be carried out at each change of tenant. The aim is to re-let the flats at market prices, in accordance with the lease law, which will increase the distributed yield and have a positive impact on the value of the asset over time. Part of the additional income from increased rents will be set aside in the renovation fund account.

2. Long-term works

Like the immediate work, the long-term work, budgeted at CHF 545,100, will aim to improve the building’s energy performance, with the complete renovation of the façade for additional insulation and the replacement of all the windows with triple insulating glass. This will significantly improve the energy performance of the building, which will have a better energy performance than that set in the 2050 objectives of the canton of Vaud.

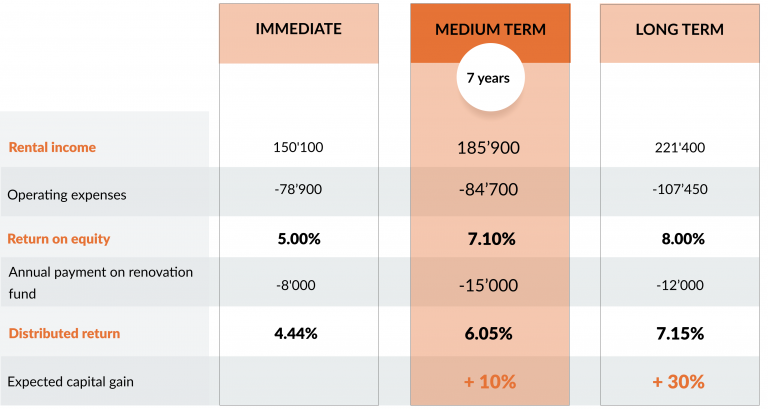

It is therefore expected that the return will increase as the work progresses and value is added. The return on equity, initially 5%, is discounted to 7.10% in year 7 and 8% in year 14. It is estimated that this increase in return will be accompanied by an increase in the value of the building of 10% in year seven and 30% in year fourteen.

An investment that is part of a sustainable approach

In addition to creating financial value, value-added investment has a positive environmental impact. Investors contribute to the reduction of greenhouse gas emissions by replacing fossil fuels with renewable energy, as well as to the improvement of the existing building stock and quality of life.

At a time when high demand for rental properties is driving down their yields, investors will need to be astute if they are to generate returns as high as in the past. With Foxstone’s dynamic property management professionals, value-added investment in properties that at first glance appear to be run down offers opportunities for increased yields and appreciation that are not available with the purchase of a new property.