The relationship between Risk and Return

Why does one property offer a higher return than another? This article provides elements to understand and compare the returns of different real estate investments.

What is the relationship between the return and the risk of a real estate investment?

Introduction

One of the most important elements to consider when making an investment is the return. Yield is a ratio that measures the performance of an investment. It is obtained by dividing the income by the amount invested. In the case of a real estate investment, the income corresponds to the rental income and the amount invested to the purchase price.

The acquisition price is therefore one of the determining elements of the yield. There is a direct link between the yield and the level of risk of an investment: For the same income, investors will want to pay a lower price for an investment with a high level of risk and conversely, a safer investment will offer a lower yield since investors will be willing to pay a higher price for the same level of income. In general, the riskier an investment is, the higher the return should be.

In real estate, as in other sectors of the economy, comparing returns is like comparing levels of risk. The main risks associated with real estate are :

- The risk of vacancy: the risk that a property will remain unoccupied for a certain period of time while the owner must continue to assume expenses without receiving any income.

- The risk of obsolescence: the risk of having to assume work that will have a negative impact on the return on the investment.

There are three aspects to understanding the levels of risk and therefore why one property offers a higher return than another: the location, the property itself and the financial aspect.

1°/ Location

The location must be analyzed at two levels: Macro-situation (region) and Micro-situation (neighborhood).

a. Macro-situation

A region is considered attractive if it has a large number of employers and a low unemployment rate, strong demographic growth and a positive migratory balance, good transportation infrastructure and a favorable tax level. When these factors are combined, rental or purchase demand tends to outstrip supply, driving up prices and lowering returns.

The risk of having vacant units is higher in an outlying region, because if rents fall overall, its inhabitants will tend to move to attractive regions close to their workplaces.

In concrete terms, a property located in the center of a large urban area will have more rental and purchase demand than a property located in an outlying rural area. The risk of vacancy for the first property is therefore lower and its return will be lower than that of the second.

For this reason, in outlying areas, Foxstone selects investment properties with below-market rents or new construction, as these will always be more attractive than other properties in the same area, thus mitigating the risk of vacancy.

b. Micro-situation

From a micro-situation perspective, a well-located building in an attractive neighborhood will always be more attractive than a poorly located building in a less desirable neighborhood. This applies to all regions and is based on factors inherent to the well-being of the tenants, such as the proximity of infrastructure such as supermarkets, public transportation or amenities such as gardens or landmarks.

For example, a building facing a railroad track will rent less easily than a building bordering a park with trees. For the same rental income, investors will be willing to pay a higher price for the well-placed building because the risk of vacancy is lower; this also implies a lower yield.

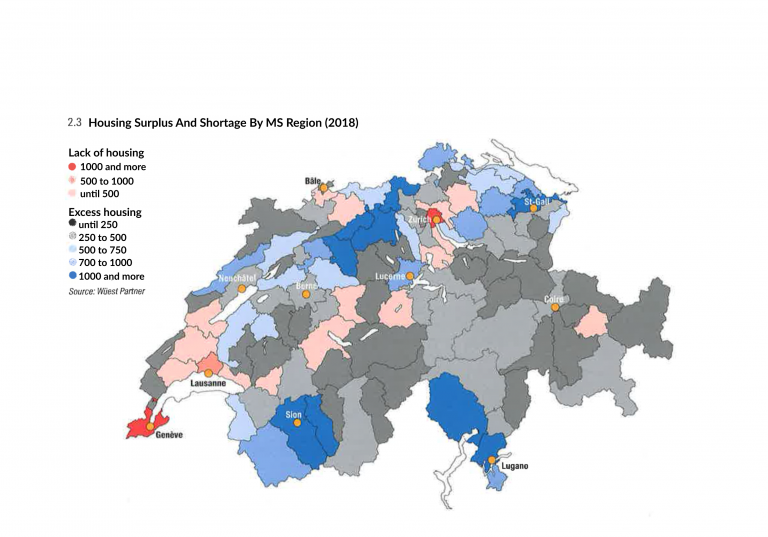

c. Housing supply

The supply of housing also plays a role and ongoing construction projects must be taken into account. An investment property in an area with high construction activity will have a higher probability of ending up with vacant units if supply absorption is poor. This phenomenon of excess supply can be observed in the Valais plain with the appearance of free rent for new constructions. Conversely, a region with a housing shortage and a positive migratory balance, as is currently the case in Lausanne, should easily be able to absorb construction activity despite other less attractive regions. These cantonal disparities can be seen on the map below, which shows the status of the housing surplus or shortage by region in 2018.

Source: Wüest & partner 2019, Immo-Monitoring (spring edition) p.29

By the same logic, commercial real estate is riskier than residential real estate and for two properties located in the same neighborhood, the commercial property will have a higher return. This is due to the fact that people will always need a roof over their heads but not necessarily a commercial property, as consumption and work habits change.

2°/ The building

a. Condition

A new building will tend to be more attractive for renting and buying and will require less renovations than an older building. A dilapidated building must be proposed at a lower price than that of a building in good condition considering the expenses to be undertaken for the work. A building in poor condition will also have more difficulty finding tenants, which increases the risk of vacancy. Investors therefore expect a higher return in case of dilapidation.

b. Rents and fixtures

A building with rents below the market average is less likely to have vacancies because, for two apartments of equivalent size and location, the one with the lower rent will be more likely to be taken. Eventually, rents should adjust to the market. This is known as a “rental reserve”, which means that rents can be increased. However, this is conditional on improvement work to bring the apartments up to current standards. Insofar as these works are not consequential, investors are ready to pay a high price for a building with an important rental reserve which has as a consequence to lower its return.

Finally, a building composed only of six-room apartments will have more difficulty in finding tenants than a building composed of apartments with various typologies ranging from studios to six-room apartments and which would better meet the demand.

3°/ Financial aspect

a. Charges

A building with low expenses will have a higher profitability than a building with more important expenses as the comparative table below illustrates it. This is one of the reasons why it is more prudent to compare the return net of charges, without bank leverage.

It should also be noted that in certain cantons, it is common to see a part of the expenses such as the concierge or the maintenance of the common areas being rebilled to the tenants.

b. Mortgage debt ratio 3

Finally, the higher the debt ratio, the higher the level of risk. In the event of a rise in interest rates, the increase in interest charges will be more significant for a building with a high debt ratio. This risk must therefore be reflected in the net return after mortgage leverage.

A property acquired with a 30% mortgage leverage will require more equity than a property with a 65% mortgage leverage and its net return on invested equity will therefore be lower. The table below illustrates the impact of credit leverage.

In order to mitigate leverage risk, Foxstone fixes the mortgage interest rate for a minimum of seven years to protect investors from the negative effects of a rate increase during that period. In addition, the mortgage is 1st ranking; i.e. the mortgage debt ratio does not exceed 66% of the value of the property – whereas in Switzerland, the mortgage debt ratio on residential properties can reach 80%. By lowering the mortgage debt ratio, Foxstone reduces the risk of defaulting on mortgage interest and charges because the building is self-financing with large margins of safety – rental income covers 5 to 6 times the mortgage interest and the project is self-sustaining.

Conclusion

As a general rule, investors tend to prefer a low return when the probability of receiving income is high. Therefore, the return on an investment is directly related to its level of risk and when comparing the returns on several investments, one must also compare their risk levels. It is therefore essential to be aware of the risks taken in order to mitigate them as much as possible. One way to improve the risk/return ratio is to diversify by buying properties in different locations; this is the principle of not putting all your eggs in one basket.

READ ALSO – Real estate crowdfunding: the solution to facilitate real estate successions

Like any investment, real estate involves risks, but it is a tangible asset with little volatility and stable income. During the current period when bond rates in Swiss francs offer zero or even negative returns, and stock markets are experiencing strong turbulence, real estate is an alternative of choice to put your savings to work. Few assets offer the same return on investment at similar risk.