The difference between performance and appreciation

When it comes to assessing the performance of a real estate investment, many people stop at rental income. However, this perspective is incomplete because the performance of a real estate investment consists of two parts:

- The net rental income distributed after deducting the operating and maintenance costs of the property,

- The evolution of the value of the property.

The rental income can be compared to dividends or interest paid by shares or bonds respectively, while the evolution of the value of the property corresponds to the variation in price.

Measuring performance through net rental income

This part of the performance of a real estate asset is derived from the recurring rental income received through rental receipts. From this rental income, operating costs (heating, electricity, management, etc.) and maintenance costs are deducted, as well as the cost of the mortgage debt (interest and any amortisation) to arrive at the net rental income paid to the owner.

This income depends mainly on the management of the property and the regional rental market. If, for example, many new rental properties are built in a region where demand is low, this will result in an increase in supply, which will put downward pressure on rental prices or increase the vacancy rate of the property. In both cases, the income received by the owner will decrease.

However, thanks to statistics and studies provided by expert firms, it is possible to identify trends in the evolution of regional markets. It is therefore possible to make medium and long-term income projections.

Measuring performance through value development

The evolution of the value of a real estate asset depends mainly on two factors: the fluctuation of supply and demand and the development of the building.

The fluctuation of supply and demand is a factor external to the building. It is linked to market dynamics which are dependent on various elements, such as the mortgage interest rate. A low interest rate will reduce the interest burden and encourage demand for properties, which will lead to an increase in their price. Conversely, a high interest rate puts downward pressure on prices.

Unlike rental income, it is difficult to predict the evolution of supply and demand, which depends on various and unpredictable causes. For example, the slightest decision on monetary policy can have consequences on the evolution of the property market.

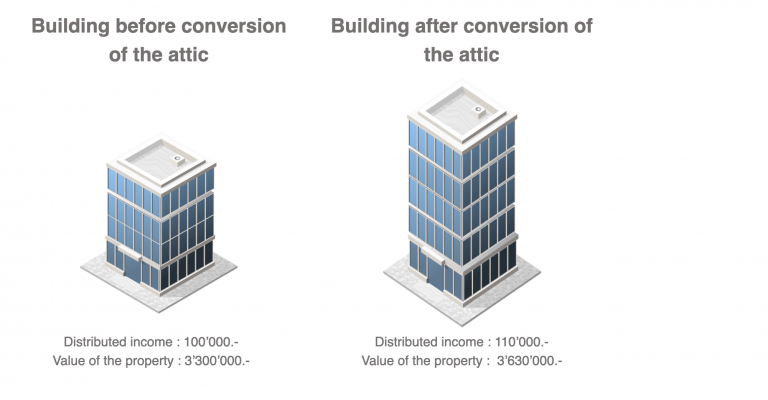

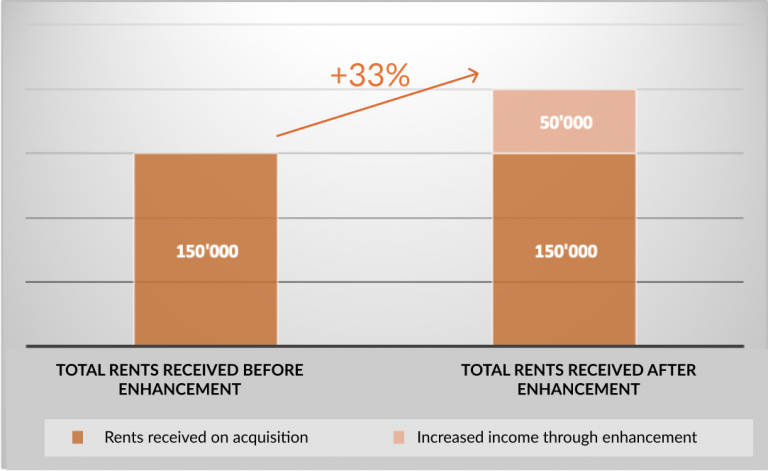

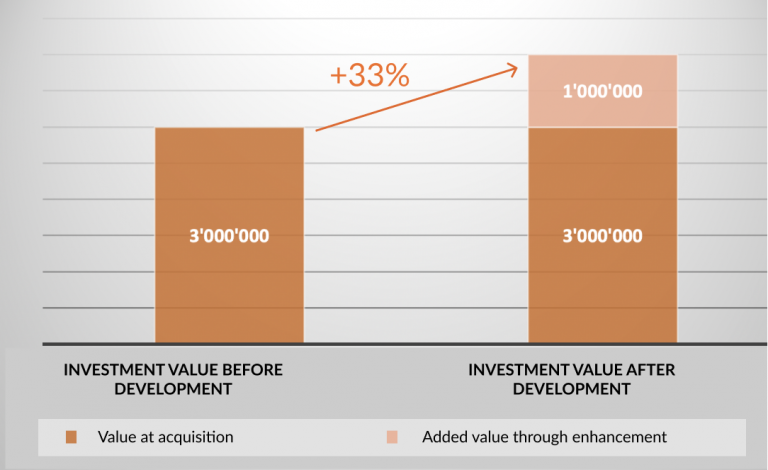

Building enhancement is a property-related factor, which consists of refreshing or improving a building. The work can be technical, such as improving the energy performance of a building, or aesthetic, such as refurbishing a façade or refreshing a flat. It is an excellent way of increasing the value of a property asset. Unlike market fluctuations, the work to be carried out is entirely predictable and controllable and has the double advantage of increasing rents as well as the value of the property. For example, converting the attic space of a building to create additional rental units will increase its rental status and value. The same applies to any work that will result in higher rents and increase the value of the building.

READ ALSO – The different real estate investment strategies

Overall performance

The overall performance of a property investment takes into account rental income and the evolution of its value. However, it is important to note that the performance linked to the appreciation in value of an asset only materialises when it is resold. Until the resale, this appreciation remains theoretical.

The evolution of the value of an asset is an important part of the calculation of the total performance of a property investment.

In practice

There has been a significant increase in the value of real estate, due in particular to the low interest rate environment which creates a lack of investment alternatives and particularly favourable conditions for real estate investments. As a result, the Swiss real estate market has been taken over by private and institutional investors, but for different reasons.

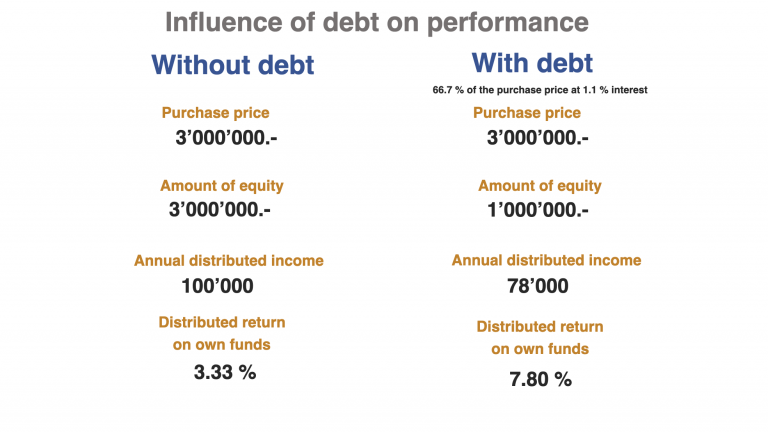

For private investors, whose real estate purchases are made with a portion of mortgage debt, low interest rates mean low interest costs.

For institutional investors (pension funds, occupational pension funds, insurance companies, etc.), low interest rates mean low returns on the bond market, for which the real estate market is the main substitute, as they share two characteristics sought by these investors: a stable return and a low-risk investment. Institutional investors have a duty to earn a return on their liquid assets, such as pension fund payments. In the current low interest rate environment, a significant proportion of this cash is invested in real estate. This large influx of cash is boosting demand and driving up prices rapidly.

As with any asset, the relationship between yield and purchase price is mechanical, the higher the price, the lower the yield (Yield = Income ÷ Purchase price).

Conclusion

In today’s environment of rising property prices, it is crucial to remember that the distributed yield is not the only measure of profitability of a property investment. If the distributed yield decreases, it is likely that the value of the property will increase.