The current transformation of access to Swiss real estate

By Nicolas Terrier

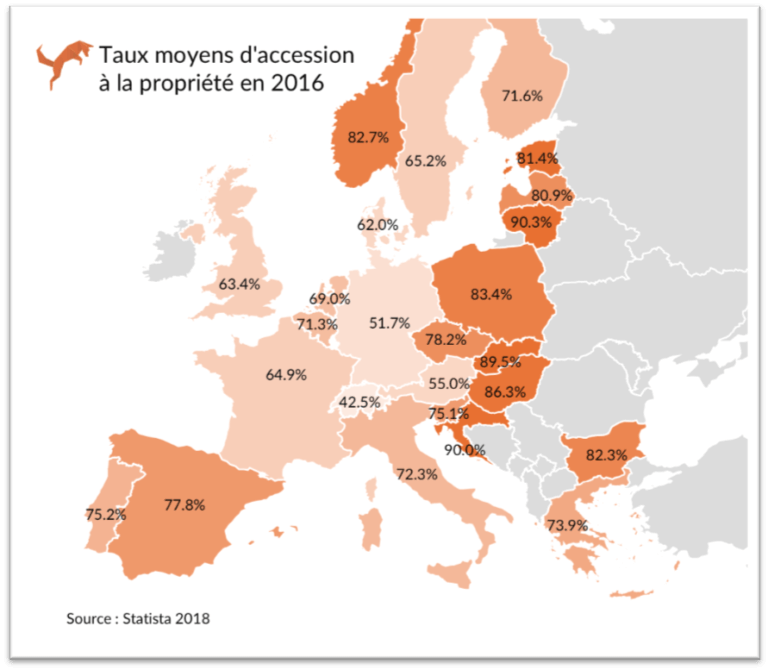

According to Statista (2016), Switzerland has for many years had the lowest homeownership rate in Europe at 42.5%, compared to 51.7% for Germany and more than 70% for Belgium and Italy. Swiss residents, therefore, have restricted access to homeownership.

The Swiss: tenants for life?

According to Wüest & Partner (2018), the median price of a three-bedroom apartment in Switzerland is around CHF 900,000. According to FINMA standards, the required equity capital amounts to 20%, or CHF 180,000, not including acquisition costs (notary, schedule, sales commission).

To determine whether or not the bank grants a loan of CHF 720’000, the bank will carry out a simulation to determine the minimum income of the buyer, which includes 5% simulated interest on the debt, 1% on average maintenance costs on the value of the property and a 1% depreciation to reduce the debt which is greater than 66% of the market value. The total expenses would be CHF 52’200. Deducting the estimated annual rental income of CHF 17’400, we arrive at a total of CHF 34’800.

Therefore, the minimum annual income required is approximately CHF 104,400, based on a cost/income ratio of 33% as required by the Swiss Bankers Association (SBA). If we compare this with the average disposable income in Switzerland, which amounts to CHF 83,500 for a household of 2.17 people (FSO, 2015), we realize to what extent access to homeownership is not within everyone’s reach.

And if the same exercise is carried out for the large urban centers, the gap is just as glaring. For example, in the Geneva region, the median price of an apartment of a similar size is around CHF 1,400,000 and the average income is around CHF 144,000 per household (OCSTAT, 2014). In addition to the necessary equity of CHF 280’000, the bank requires a minimum annual income of around CHF 154’000 per household assuming that the property is rented at CHF 30’000.

High barriers hinder access to real estate, which is reserved for a closed circle. These include the minimum investment volume, limited financial capacity, the need for specialized knowledge, or simply the fact that good projects are exchanged between insiders.

Use of investment via real estate crowdfunding

Although access to property is difficult for the vast majority, crowdfunding offers the possibility for private individuals to invest in stone from CHF 25,000 in order to gain access to rental income. New in Switzerland, this type of participatory financing represents a solution to circumvent entry barriers. It is a passive investment since the platforms offer a turnkey service, from transaction to management. The required expertise is provided by real estate professionals. In addition, the rental risk is mitigated since, in the absence of owning an apartment containing a tenant, each investor owns a fraction of a building.

Why is real estate so attractive today?

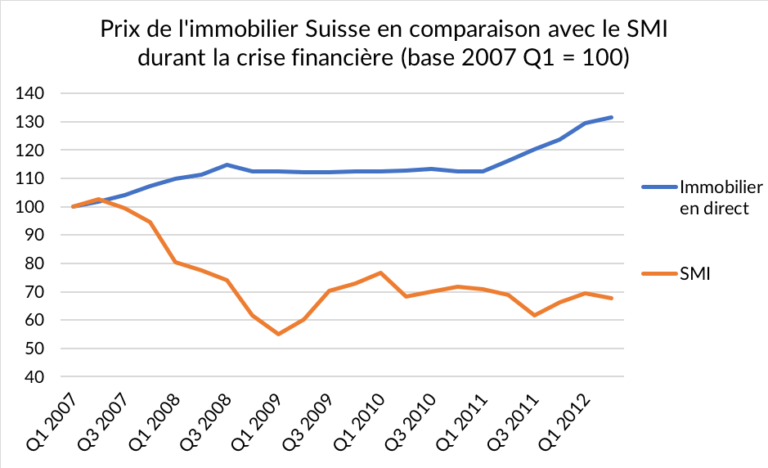

Real estate is a tangible investment with stable income. Few assets offer such a return on investment at similar risk. Another argument is that stone in Switzerland is one of the only sectors to have weathered the subprime crisis in an upward direction, as can be seen in the graph below. During the period, the gain in the real estate price index by Wuest & Partner (2018) was 12.4% while the SMI (SIX Swiss Exchange, 2018) lost 29.2%.

Real estate is facing a housing shortage in some major centres and, according to the Federal Statistical Office’s reference scenario (2018), the Swiss population is expected to rise from CHF 8.3 million to CHF 9.5 million in 2030. In other words, population growth is expected to increase by 14% over the next ten years and all of these inhabitants will undoubtedly need to be housed.

Inaccessible to the majority of the population, real estate investment via crowdfunding is becoming the new opportunity. Started in 2016, the real estate crowdfunding sector tripled to reach CHF 116 million in 2017 according to the Crowdfunding Monitoring Switzerland 2018 of the Institute of Financial Services in Zug, demonstrating the current craze for this asset class.

References

- Prof. Dr. Andreas Dietrich, S. A. (2018). Crowdfunding Monitoring Switzerland 2018 . Institute of Financial Services Zug (IFZ).

- SIX Swiss Exchange. (2018, 08 01). Data center. Récupéré de SIX: https://www.six-swiss-exchange.com/indices/data_centre/shares/smi_en.html

- Immobilier en direct : Indice IAZI couvrant 60% des transactions d’appartements en PPE et villas en Suisse, soit 25’000 transactions par an (référence CH0030532342)

- SMI : Le SMI® est l’indice d’actions le plus important de Suisse et comprend les 20 principaux titres du SPI. Il couvre environ 80% de la capitalisation totale du marché suisse des actions (référence CH0009980894)

- Statista. (2018, 09 24). Homeownership rate in selected European countries in 2016 .Récupéré sur Statista: https://www.statista.com/statistics/246355/home-ownership-rate-in-europe/

- Ulrich Braun, Christian Braun et Zoltan Szelyes. (février 2017). Real Estate Strategies. Credit Suisse.