Swiss National Bank’s Key Rate Cut: New Perspectives for the Swiss Real Estate Market

On March 21, 2024, the Swiss National Bank (SNB) caught the market off guard by announcing a key rate cut of 25 basis points, lowering it from 1.75% to 1.50%. This move, expected by observers to occur in June, is driven by a set of clear motivations: controlled inflation, an appreciation of the Swiss franc, and economic growth below trend. For real estate investors, this announcement opens a horizon of reflections and opportunities. This article delves into the implications of this decision for the Swiss real estate market and how investors can navigate this new environment.

Context of the SNB’s Decision

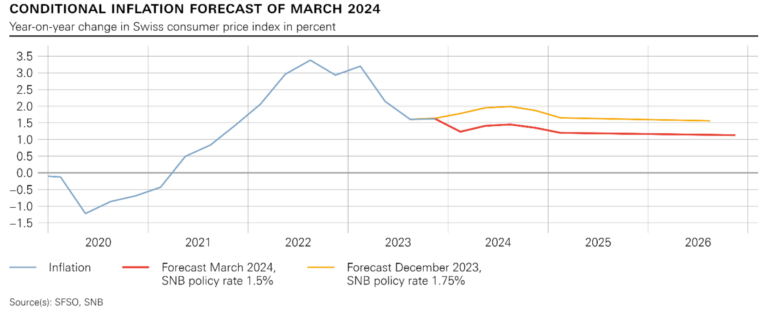

The SNB’s decision is based on controlled inflation, which marked a significant decrease to 1.2% in February. The appreciation of the Swiss franc and moderate economic growth in Switzerland also played a key role. With two more cuts of 25 basis points expected in June and September, the key rate could reach 1% by the end of the year. However, UBS points out that uncertainty and market volatility make it difficult to predict future developments accurately, highlighting a changing economic environment. Bond markets, having anticipated these cuts, have already made the necessary adjustments, suggesting an immediate impact on long-term interest rates.

Implications for the Swiss Real Estate Market

Mortgage rates are expected to benefit significantly from these adjustments. A decrease in interest rates makes financing more affordable, potentially stimulating demand for real estate. Investors and buyers could thus take advantage of more favorable conditions to engage in the market, which could boost real estate demand in an already robust market.

New Opportunities and Challenges

The key rate cut invites a rethinking of investment and real estate acquisition strategies. Investors might see this situation as an opportunity to finance projects at lower costs, thereby increasing the potential return on their investments. However, this changing economic context also requires a careful and nuanced analysis of risks, particularly concerning future rate and inflation developments.

Conclusion

The SNB’s key rate cut opens new perspectives for the Swiss real estate market and for Foxstone investors. With potentially lower borrowing costs and rising real estate demand, now is an opportune time to assess and seize investment opportunities. By staying informed and strategic, investors can successfully navigate this new environment, optimizing their returns. Foxstone is ready to support its investors in this process, paving the way for new real estate successes in an evolving market.