Rising prices and eroding yields in rental property

For the past 15 years, prices for investment properties have been setting annual records for those who follow them, and 2021 was no exception. This increase in prices automatically leads to a decrease in rental property yields.

Following the financial crisis of 2008, Swiss real estate investments were in high demand. This interest increased when the SNB introduced negative key interest rates in January 2015. The low interest rate environment has attracted a lot of capital to real estate because the guaranteed return on real estate is higher than that on fixed-interest bonds (1). The shortage of investment opportunities has driven up the price of investment properties, which many investors see as an alternative to bonds with their stable income and low risk of capital loss.

Institutional investors are leading the way. For several years now, pension funds have been allocating an increasingly substantial portion of their portfolios to real estate investments, which in 2009 represented an average of 18.5% of their portfolios, compared with 24.4% in 2020 (2), as illustrated in the graph below. For example, in Geneva, foundations and pension funds accounted for 37% of all investment property transactions in 2020. If we add insurance companies, we can see that they hold a dominant position with 55% of the volume exchanged (3). This strong demand has intensified further in 2021, once again driving up prices.

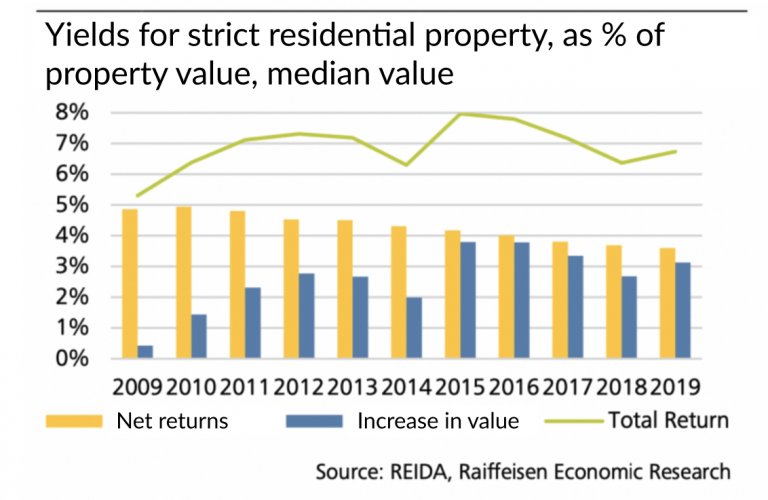

The yield of a building is a ratio between its net rental income (rent minus all charges) and its price (yield = income ÷ price). As the rental income of buildings has not increased at the same rate as their prices, this has had the mechanical consequence of lowering yields. On average, the net rental income of professionally managed investment properties in 2010 was around 5%. By 2019, they had fallen from around 1.5% to around 3.5%. (4)

The consultancy PwC notes that this decline has continued into 2021 due to strong demand. The net yield of rental properties nationwide in June 2021 was 3.4% (5). According to a survey of experts conducted in March 2021, the lowest figures were recorded in the Lake Geneva region (2.5%), the greater Zurich area and central Switzerland (both 2.6%). (6)

These declines in rental yields have been largely offset by soaring property values. In 2019, despite the fall in income, the total return (income + property value appreciation) was roughly similar to 2010, at around 6.5%. (7)

Credit Suisse notes that “according to the SXI Investment Real Estate Performance Index, which covers around half of all OTC transactions in Switzerland, price growth accelerated last year. In Q4 2021, for example, transaction prices gained 5.9% compared to Q4 2020, with the overall return even reaching 9.1%.” (8)

If negative interest rates persist, an assumption shared by most investors, real estate investments will continue to offer an attractive risk/return profile compared to other available options. Investors’ preference for residential investment property will persist and yield requirements will continue to fall. (9)

As Raiffeisen points out, “For an investor, this development naturally raises questions about the appropriateness and sustainability of the decision to buy at ever higher prices for ever lower incomes. However, one only has to look at the returns on other investments with a similar risk profile to see that despite the higher vacancy risk, lower initial rents and higher prices, property investment will still pay off for some time. It is therefore likely that a lot of capital will continue to flow into the investment property market in the future as well“(10)

(1) Wüest Partner, Immo-Monitoring 2021 | 2 – Explication économique des évolutions de prix des immeubles de rendement

(2) Swisscanto Prévoyance SA – Étude sur les caisses de pension en Suisse en 2021

(3) Acanthe Expertise Immobilière & Naef Investissement et Commercial, Marché de l’Investissement Immobilier Romand 2021

(4) Raiffeisen Economic Research, Immobilier suisse – 2T 2021 | La propriété ce privilège

(5) PwC-Immospektive, Interprétation de la newsletter «Méta-analyse immobilière novembre 2021», 19 novembre 2021

(6) PwC-Immospektive, Interprétation de la newsletter «Méta-analyse immobilière mai 2021», 21 mai 2021

(7) Raiffeisen Economic Research, Immobilier suisse – 2T 2021 | La propriété ce privilège

(8) Credit Suisse AG, Investment Solutions & Products, Marché immobilier suisse 2022 | Mars 2022

(9) PwC-Immospektive, Interprétation de la newsletter «Méta-analyse immobilière mai 2021», 21 mai 2021

(10) Raiffeisen Suisse société coopérative, Immobilier suisse – 2T 2021 | La propriété ce privilège