Real estate crowdfunding: a powerful tool for diversification

Introduction

Diversification is a management strategy that consists of a varied asset allocation in order to optimise the stability and overall return potential of a portfolio by reducing volatility and therefore the risk of loss. It is the well-known principle of not putting all your eggs in the same basket.

While most investors are aware of the risk of investing in a single share, asset type or sector, they overlook the risk of investing in a single market. Although they diversify their investments across different assets, these investment vehicles are generally all traded on a publicly traded market. As stock markets are becoming increasingly correlated [1], as can still be seen during the simultaneous collapse of stock market values in early 2020, it is difficult to achieve significant diversification in a public market.

In this article we will examine how real estate provides good diversification due to its low correlation with financial markets, and then we will analyse the different possibilities available to investors within this asset class and their advantages and disadvantages.

Decorrelation of direct real estate investment

Unlike shares and bonds traded on listed public markets, real estate is bought and sold on a private over-the-counter market [2]. Private markets are less efficient than public markets because transactions are much less frequent, take more time and generally involve higher costs (e.g. notary and land registry fees). These barriers represent a protection for investors, as lower transaction volumes reduce liquidity and especially volatility.

As a result of these different dynamics, investments in private markets generally have little or no correlation with listed markets. Changes in the stock market values of equities and bonds are unlikely to result in a change in the value of a property. For this reason, real estate offers a powerful diversification against market risk. They also allow those with the necessary knowledge, skills and resources to gain a competitive advantage through careful management.

IAZI CIFI – Indices SWX IAZI (source)

The diversification advantages of direct real estate

Real estate’s low correlation with the financial markets, its history of long-term appreciation and regular income make it a very powerful diversification tool in a portfolio.

Real estate is fundamental to the functioning of the company and therefore has different cycles from those of stocks and bonds. While the value of public equities may fluctuate according to investor perceptions and in response to geopolitical events, the demand for real estate assets tends to reflect more tangible demographic trends and macroeconomic factors and to evolve more slowly.

In addition, the current environment of historically low interest rates makes Swiss franc bond investments unattractive and offers favourable financing conditions for real estate acquisitions. Investors must therefore seek regular sources of income outside of bonds.

Thus, for several decades institutional investors, such as pension funds, have been allocating a substantial part of their portfolios to direct real estate investments. A study conducted in 2019 by Swisscanto Pension Fund Ltd. found that the proportion allocated to real estate by pension funds in Switzerland increased from 18.5% in 2009 to 24.8% in 2018, as illustrated in the graph below.

Source: Swisscanto Prévoyance SA – Étude sur les caisses de pension en Suisse en 2019

Until recently, there has been little access to direct real estate investment by individuals, as this market was generally restricted to institutional or high net worth investors. However, legislative and technological advances have recently introduced new options that help to make direct real estate investment more accessible, allowing for advanced diversification.

Real estate investment alternatives

There are several ways to diversify a portfolio with real estate investments, each requiring different expertise and commitment. There are three main options available to investors, each with its own advantages and disadvantages and different diversification potential.

1. Direct real estate investment

This option generally consists of buying a condominium to rent. This is an active form of investment that requires significant expertise and can be time consuming.

Moreover, in Switzerland, in order to avoid short-term speculation, large capital contributions are required to acquire a property. For example, according to the Wüest & Partner (2018) law firm, the median price of a three-bedroom flat is approximately CHF 900,000. According to FINMA standards, the equity required for this acquisition amounts to 25% of the value of the property, i.e. CHF 225,000, plus the acquisition costs (notary, schedule, sales commission). It will also be necessary to bear repair costs throughout the investment and to be able to pay the required depreciation.

Direct real estate investment is problematic from the point of view of diversification. Although it is a direct investment uncorrelated to the financial markets, an individual flat has a high risk of vacancy, with the risk of rental vacancies being concentrated in a single tenant. If it remains unoccupied for several months, as the sole or one of the few active real estate investments held by the investor, the investor will suffer a significant loss, and as sole owner of the investment, it will fully bear this loss, in addition to the charges it will continue to pay.

Given the capital required, potentially over long periods of time, it is difficult for individuals to diversify their portfolios into several direct real estate investments; it usually takes several years or a large initial amount.

The main advantages of direct real estate investment are that the owner has a right of use over the property, i.e. the right to live in it, and complete freedom of choice in the allocation of its assets.

2.Real estate funds

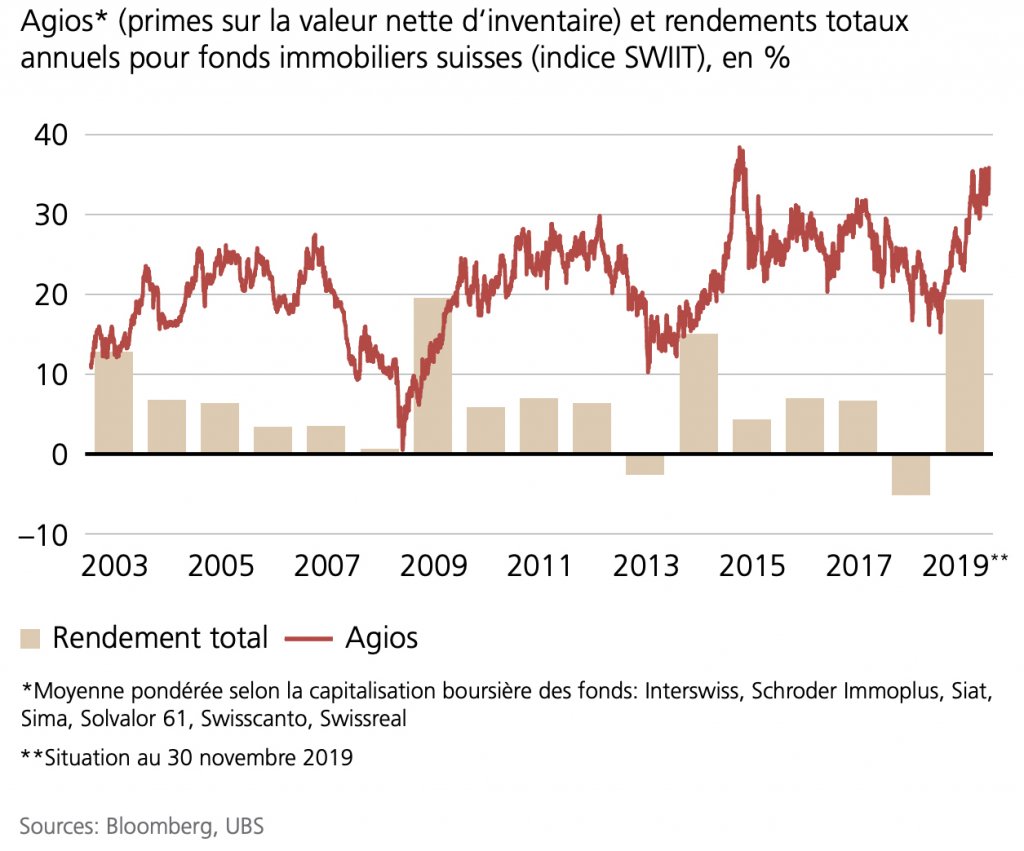

Listed real estate funds offer undeniable advantages. With a small amount, the investor dilutes his investment over hundreds of rental units spread over different geographical areas. They offer daily liquidity, but this is accompanied by a premium (agio), the value of which can vary. The chart below illustrates the changes in the premium for Swiss real estate funds over the past few years.

Their major problem is, as their name suggests, that they are listed on public markets and therefore do not offer the fundamental advantage of private real estate investment. Because they are listed, they share the same risk characteristics with other publicly traded investments; reflecting broader market perceptions, they tend to be more closely correlated with the stock market than private real estate assets.

Non-listed real estate funds have the advantage that they are not publicly traded and therefore offer a better decorrelation of financial markets than listed real estate funds. In Switzerland, however, the majority of unlisted real estate funds are closed-end funds and generally require a substantial minimum investment. This asset class has therefore generally been restricted to institutional or high net worth investors.

Moreover, it is not possible to exit from it without raising funds or selling assets.

3.Real estate crowdfunding

There is now a third alternative for investing in real estate that combines the advantages of direct real estate investment and real estate funds.

Real estate crowdfunding consists of bringing together several investors to enable them to jointly acquire an existing and already rented property with a view to receiving rental income. The investors, registered by name in the land register, are co-owners of part of the entire building and delegate its management to professionals. The minimum investment (CHF 25,000 at Foxstone) is much more affordable than that required to purchase a flat.

With an initial contribution of CHF 25,000, the risk of vacancies is already diluted for several flats. If one of them remains vacant or one of the tenants does not pay its rent, the co-owners continue to receive the rents for the other dwellings. Property crowdfunding therefore allows a dilution of the rental risk from the first investment.

Investors also have the possibility to spread their funds over several properties located in different geographical areas to achieve a greater diversification of their assets. They have the same freedom in choosing their asset allocation as with a direct investment and more flexibility in terms of amount. They can choose to favour established urban areas, such as Lausanne or Geneva, which have diversified demand drivers making them relatively safe, or peri-urban areas with more attractive returns. Established urban areas are highly sought-after and face strong competition among investors, which results in lower potential returns. Investors are in control of the choice of allocation whereas with a fund the properties can be sold or bought without the approval of the unitholder.

As real estate crowdfunding is a direct real estate investment made in a private market, it offers the same level of stock market decorrelation as any direct real estate investment.

Ultimately, it also has the advantage of being more liquid and offering more granularity than an investment in a flat. Each co-owner can put up for sale, at any time, part or all of his or her shares and the platform takes care of finding a replacement within the co-ownership.

Conclusion

Good diversification is key to maximising returns and reducing portfolio volatility. It is therefore important to build a portfolio that is balanced between different asset classes (equities, bonds, commodities, real estate).

Direct real estate investment is a powerful diversification tool in a portfolio due to its low correlation with the stock markets. With its history of long-term appreciation and recurring income, it is an increasingly popular alternative for institutional investors and is now accessible to the Swiss middle class thanks to real estate crowdfunding.

Références

1 Correlation is a coefficient that measures the extent to which the performance of different investments moves in the same direction over a period of time with a similar magnitude. If the returns of two assets move in the same direction with the same amplitude over the same period, they are considered to be perfectly positively correlated. If they move in opposite directions to the same extent and at the same time, the assets are considered to have a perfect negative correlation.

When investments are correlated, they share the same risks. If one investment suffers a loss, then another investment that is correlated to it may also suffer a loss. On the other hand, if a portfolio is spread between decorrelated assets, the performance of one or more investments may mitigate the losses of other less performing assets.

In general, the more a portfolio contains investments with little or no correlation, the more diversified it is. On the contrary, a poorly diversified portfolio is prone to high levels of volatility, unstable returns, and possibly lower overall income.

2 An over-the-counter or over-the-counter market in the financial world qualifies as a transaction entered into directly between the seller and the buyer. It is opposed to an organised market, where a commission must be paid to the relevant exchange. (Source: Wikipedia).

Swisscanto Pensions Ltd., Study on Pension Funds in Switzerland in 2019

Source: Iazicifi.ch

Source: www.investir.ch