Investing in Swiss real estate in 2024 : a safe haven?

On a European scale, political instability and relatively high inflation only reinforce Switzerland’s position as a stable anchor, capable of controlling its inflation, which is a sign of good economic health. Additionally, Switzerland is seen by many foreign citizens as a haven of stability, both for investors and qualified professionals seeking tranquility. This continuing growing attraction to Switzerland is reflected in its real estate market, which stands out as a safe haven.

A swiss real estate market unaffected by the crisis

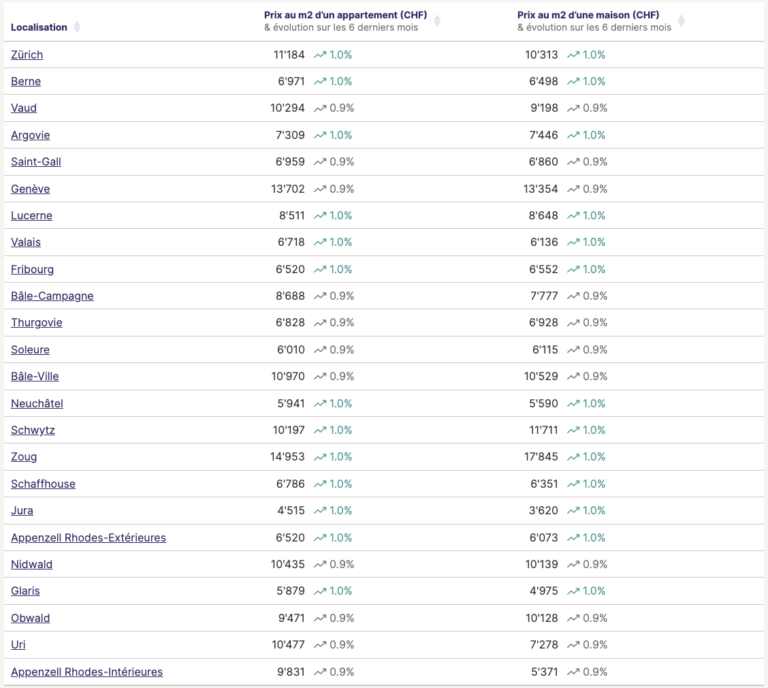

Indeed, real estate investment in Switzerland is highly coveted, contributing to a consistent rise in prices nationwide. No canton in the confederation is spared from this increase, as shown by the first summary table from June 2024 by the real estate agency Neho.

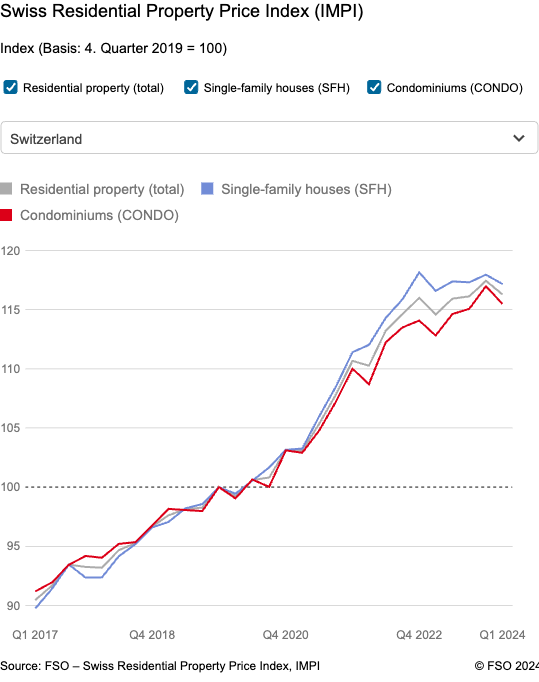

Furthermore, the price rise has been constant. The graph below shows that the increase in real estate prices accelerated from 2020, peaking in 2023. The real estate price index reached 117.4% in the last quarter of 2023, almost 17 points higher than in 2019.

* Evolution of residential real estates prices index in Switzerland, source: Office fédéral de la statistique.

Another significant figure: the price per square meter increased by 18% in 4 years (from the end of 2019 to the end of 2023), indicating an exponential demand, which in turn fuels this upward price spiral. More precise tools have been developed to help investors closely follow price trends. Neho, a disruptive player in the real estate market, offers a price simulator by region (for example Geneva here) that allows users to determine within seconds the cantons and municipalities experiencing strong growth and those with more affordable prices. Their data is also contextualized with their own real estate portfolio to provide concrete visibility on the supply.

The Swiss real estate Eldorado: a profitable oasis of stability

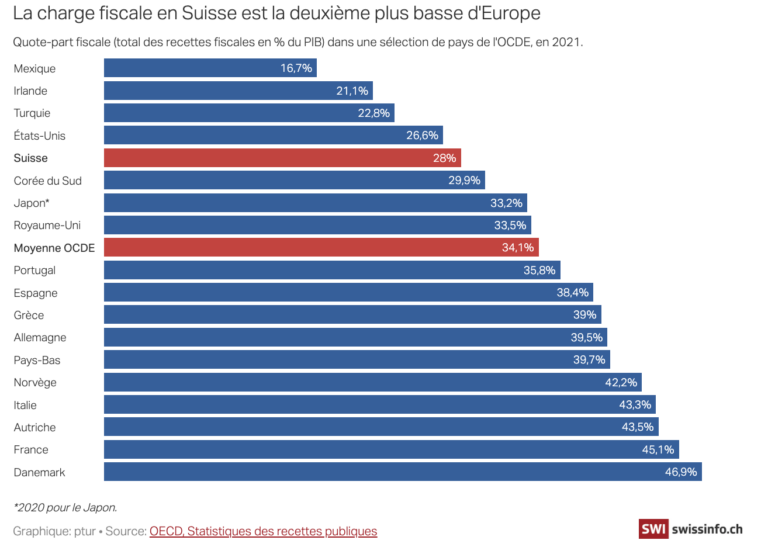

The European socio-political and economic context pushes citizens, especially the wealthiest, to relocate to Switzerland in search of a more peaceful environment. Additionally, the tax regime is another significant argument in the balance. Despite cantonal disparities, Swiss taxation remains one of the lowest in Europe, being among the least demanding in taxes (second place behind Ireland).

*The tax burden in Switzerland is the second lowest in Europe.

In March 2022, the Swiss National Bank (BNS) lowered its rates, with further reductions expected in the near future (end of 2024). These lower rates also stimulate the real estate market by creating more favorable financing conditions. Hence, a combination of multiple factors exacerbates tensions on the real estate market prices. Consequently, owning property in Switzerland is becoming the preserve of wealthy investors, while the majority of middle-class households face increasingly high barriers to homeownership, sometimes becoming insurmountable.

Real estate investments reserved for an elite ? Between dreams and reality

79%. “The average market prices are out of reach for 79% of households.”

This staggering figure perfectly illustrates the Swiss real estate reality: homeownership remains a dream for the majority of households in Switzerland. Specifically, according to the Wüest Partner analysis for the first quarter of 2024:

“For the whole of Switzerland, the average price of a typical apartment in co-ownership is 9% higher than what an average household can afford based on their gross income and viability criteria. Thus, for 58% of two-person working households, market prices are too high to obtain a mortgage covering 80% of the purchase price. The average prices of single-family homes are 27% above affordable prices. Therefore, average market prices are out of reach for 79% of households.”

Affordable prices vs. offered prices: 1 market, 2 realities

There is a growing gap between “affordable prices” (defined by Wüest Partners as prices based on average gross incomes and viability rules) and offered prices (those actually observed in the market).

On one hand, property prices are generally rising across Switzerland, even though there are regional disparities. For example, according to the latest estimates by Neho for the canton of Geneva, it remains one of the most attractive areas. The median price per square meter reaches around CHF 13,000 in the canton (for houses and apartments combined). This upward trend is not exclusive to the Geneva region.

On the other hand, potential buyers’ capacities are restricted by several factors, affecting their wallets and financing abilities. Firstly, income growth has not kept pace with the rise in interest rates or property prices. Additionally, strict mortgage rules, such as the requirement to provide 10% of the purchase price in hard equity, further reduce access to homeownership. Moreover, banks offer mortgage interest rates that are significantly higher than the theoretical rate (a less conservative and thus more “generous” calculation) to maintain a margin for default risk. Finally, even if these calculation criteria were relaxed, they would open the floodgates for property demand against a stable and relatively low housing supply.

This trend is likely to continue, as, according to UBS economists(1), today only 15% of households have sufficient income to access homeownership, they were 60% twenty years ago.

Therefore, many households turn to alternative solutions to invest in Swiss real estate, aiming to benefit from the market’s solidity, sustainability, and attractiveness, without direct and personal purchase.

Rental real estate purchase : overcoming obstacles with innovative alternatives

If the previously mentioned obstacles seem too high to overcome, why not try to circumvent them? Several players in the Swiss real estate market offer more democratic “joint” investments. This alternative involves rental purchases : buying a property not to live in but to rent out and generate income.

Not giving up on ownership, but investing together

Co-ownership and participatory loans… you may have heard of these new investment alternatives. They are gaining popularity because they combine numerous advantages:

- They are much more affordable: starting from CHF 10,000 for the first options, sometimes CHF 20,000 or 30,000, making them accessible beyond the economic elite and allowing for customized investment amounts.

- They are not subject to the same income and financing capacity criteria used by banks for a traditional purchase.

- They are unlisted : meaning they are not linked to financial markets and their volatility.

- They offer a simple and effective way to diversify and spread risk.

- They do not require extensive expertise. Unlike complex financial products, cryptocurrencies, and other latest trends, these solutions are easy to understand and offer turnkey services, appealing to a broad audience.

- They save considerable time : most of these types of investments relieve you from the usual constraints (a rental purchase quickly becomes time-consuming, both in research and in daily management).

Crowdfunding, Crowdlending : affordable and turnkey real estate

Among the most popular participatory real estate investment solutions are co-ownership (crowdfunding) and participatory loans (crowdlending).

Co-ownership: becoming an owner without the daily management constraints

This is probably the best-known participatory real estate investment alternative and the most concrete for the general public. It involves purchasing a property together. By bringing together several investors, the entry ticket becomes much more accessible : from CHF 25,000, you can take a share in a so-called revenue property. Already rented and profitable, it generates rental income on which co-owners receive a quarterly return. The management of the building is delegated to a property management company, but the co-owners still have decision-making power and participate in major decisions related to the property management. More suited to long-term investors (5 to 8 years), this alternative is generally accessible from CHF 25,000. It is also ideal for those looking to diversify their portfolio and dilute their risks.

Crowdlending: a short-term investment with attractive returns

Also known as crowdlending, this real estate investment alternative involves lending a defined amount to a real estate developer (for new construction, renovation, etc.) in exchange for interest payments. It is possible to start investing from around CHF 10,000, depending on the projects. At the loan’s maturity, the investor recovers the initial amount invested in the financing operation. Most opportunities of this type are completed within 1 to 3 years, making them ideal for investors looking to invest funds in the short term.

(1) https://www.rts.ch/info/economie/2024/article/l-acces-a-la-propriété-du-logement-un-luxe-toujours-plus-inaccessible-pour-les-ménages-suisses-28466586.html