How to choose the right crowdlending project ?

How to choose the right crowdlending project ?

Introduction

Real estate investment was traditionally viewed as a realm exclusively for the wealthy elite, demanding substantial capital and special access to opportunities that were beyond the reach of the general public. However, the emergence of real estate crowdlending has fundamentally altered this landscape, welcoming a broader spectrum of investors. Foxstone, a trailblazing platform in Switzerland, is at the forefront of this shift, making profitable real estate ventures accessible to a wider audience and ensuring greater transparency and security. This article seeks to demystify the process of selecting real estate crowdlending projects and spotlight the critical factors to consider.

What is real estate crowdlending?

Real estate crowdlending is a form of collaborative financing where individuals jointly invest in real estate projects by lending money to developers or property owners in return for interest. This innovative approach transforms traditional real estate financing by connecting investors with project initiators. This method offers a dual benefit: it provides investors with the opportunity to access potentially attractive returns and gives borrowers the flexibility to fund their projects.

Why choose Foxstone for real estate crowdlending?

Foxstone stands out with its focus on meticulous project selection and investment security. The platform carefully evaluates each real estate crowdlending opportunity to ensure it meets specific profitability and risk criteria. This thorough analysis enables Foxstone to offer high-quality investments, thereby minimizing risk for investors while presenting them with appealing returns.

Loan structuring and yield

Foxstone structures its crowdlending projects as bond issuances. A bond is a debt security that represents a loan of money for a fixed period (the maturity). The issuer of the bond commits to paying the holder a fixed interest rate (the coupon) at regular intervals during the life of the bond and to repaying the principal at maturity.

For a bond, its yield is indicated by its interest rate (or coupon), usually expressed as an annual percentage, reflecting the ratio between the interest received and the capital invested.

The yield is a key factor in choosing a crowdlending investment. However, it is crucial to remember that, as with any investment, the yield is directly related to risk: the higher the potential return of a project, the riskier it is.

Criteria to consider when selecting a project

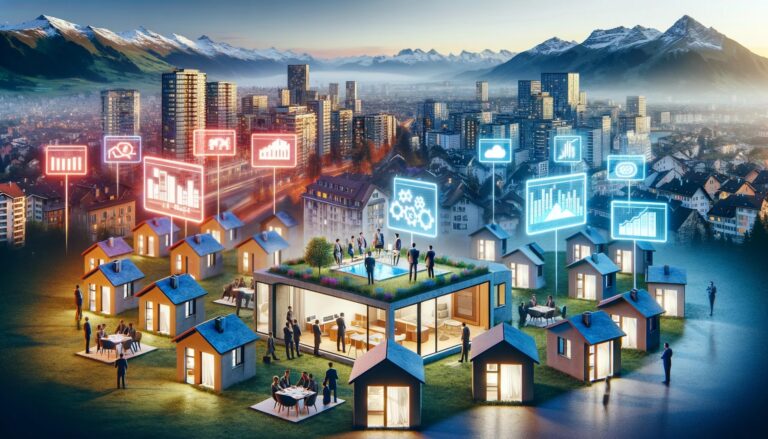

Types of projects

The projects available on the Foxstone platform range from funding new constructions to refinancing existing assets. Understanding the differences between these two types of projects can help align your investment choices with your personal preferences.

-

Financing a construction project

This option allows investors to directly participate in the financing of new real estate projects. By lending funds to real estate development companies, they contribute to the creation of new housing in Switzerland. The loan repayment is usually made from the revenues generated by the sale of the real estate once the project is completed.

-

Refinancing an existing asset

Here, the loan is granted to real estate companies that already own properties with a proven revenue history. The aim is to refinance these assets to enhance their value or support new developments. The loan repayment comes from the rental income generated by the property or, in some cases, from the proceeds of a development project carried out by the borrowing company.

It is important to note that financing development projects carries an inherently higher level of risk compared to refinancing existing assets. Construction projects can be subject to various unforeseen events, such as delays, budget overruns, or changes in the real estate market conditions, which can affect the completion and profitability of the project. On the other hand, refinancing existing assets is based on properties that already have a performance history, thus offering a certain level of predictability.

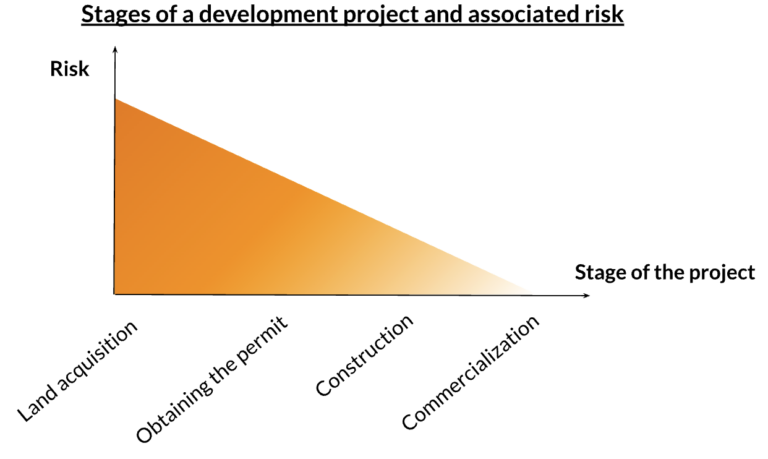

Project stage

Regarding a real estate development project, one critical aspect to consider is its stage of progress. Funding a project at an early stage carries its share of uncertainties due to several variables that can influence its evolution:

- Land acquisition

Before even the first shovel hits the ground, the project must secure land. Prolonged negotiations or unexpected legal issues can sometimes complicate this initial purchase.

- Permit acquisition

A project cannot move forward without the approval of the relevant authorities. The process of obtaining permits can face hurdles, such as opposition from neighbors. A refusal or additional requirements can significantly delay or even jeopardize the project.

- Adherence to timelines and budgets

Construction is notoriously unpredictable. Delays can occur due to adverse weather conditions, supply chain issues, or unexpected discoveries on site. Similarly, projected costs can escalate, leading to budget overruns, whether due to project modifications or rising material prices.

- Commercializing the units

Even once the project is completed, there remains the challenge of selling or leasing the created spaces. Fluctuations in the real estate market can impact demand, affecting the achievement of initial sales or rental projections.

Foxstone’s goal is to balance these opportunities with rigorous analysis and in-depth project evaluation. We strive to minimize risk for our investors by selecting projects managed by experienced teams and performing due diligence at every step of the process.

Location

In the realm of real estate, the timeless mantra “location, location, location” holds just as true for crowdlending. The location of a property is a crucial factor that directly impacts its potential for success. An apartment or villa situated in a sought-after area boasts an inherent appeal, making it more likely to quickly attract potential buyers or tenants.

Furthermore, properties situated in prime locations tend to be more resilient during real estate market fluctuations. Even in times of economic downturn, these properties maintain their value and appeal better, providing a measure of security for investors.

Every project featured on the Foxstone platform undergoes a thorough evaluation to ensure it is situated in an area with growth potential and sustained rental demand. We assess criteria such as the region’s economic development, upcoming infrastructure projects, and the local market dynamics to select solid and resilient investment opportunities.

Commercialization plan / Rental status

Two crucial elements to consider in assessing the viability and profitability of a project are the marketing plan for real estate developments and the rental status for existing properties.

The commercialization plan: A cornerstone for development projects

The commercialization plan represents the roadmap that details how a real estate development project will be introduced and sold on the market. It encompasses a variety of factors, such as:

- Market analysis: A comprehensive study of the real estate demand in the targeted area, including demographics, market trends, and local competition.

- Pricing strategy: Setting the sale prices based on market analysis, aiming to ensure competitiveness while maximizing return on investment.

- Sales and marketing channels: The methods and mediums used to reach potential buyers, including advertising campaigns, virtual tours, and real estate expos.

- Sales timeline: The key phases of the project, from the commercial launch to the final sale of units, including significant milestones to measure progress.

A solid and realistic commercialization plan is an indicator of the project’s ability to quickly attract buyers, thereby reducing the risk of financial stagnation.

The rental status: A profitability gauge for existing properties

The rental status pertains to already constructed properties, focusing on occupancy and the income generated from leases. It is a critical element because it provides:

- The occupancy rate: The percentage of units rented out compared to the total available. A high rate indicates strong rental demand and income stability.

- Rental income: The total amount of rent collected, reflecting the direct profitability of the investment.

- Duration of the leases: The average or median length of rental agreements, giving insight into the long-term security of rental income streams.

- Tenant profile: The quality and reliability of tenants, which may include solid companies, reputable franchises, or individual tenants with a good payment history.

The rental status offers a clear picture of a building’s current performance and its potential to generate stable future revenues. Foxstone carefully reviews the marketing plan or rental status for each proposed project to select only the most viable options.

Property type

When delving into real estate investment, it is crucial to differentiate between the types of properties: residential and commercial. Each segment offers unique opportunities and comes with its own market dynamics and risk levels.

- Residential real estate: Daily life proximity

Residential real estate includes properties meant for living purposes, such as single-family homes, apartments, and housing complexes. Key characteristics of this segment are:

- Stable demand and returns: Since the need for housing remains constant, residential real estate tends to offer resilience against economic fluctuations.

- Simplified financing and management: Residential projects are generally seen as less complex in terms of financing and management.

- Commercial real estate: The quest for high returns

Commercial real estate encompasses spaces used for professional activities, including offices, retail stores, warehouses, and industrial buildings. Its distinguishing features include:

- High yield potential: Higher rents and longer leases typical of commercial real estate can lead to returns exceeding those of residential properties.

- Economic cycle exposure: The performance of commercial real estate is closely tied to economic health, potentially leading to greater volatility in income and values.

- Complexity and management requirements: Managing commercial properties often involves additional challenges, such as specialized maintenance and modifications to meet the specific needs of professional tenants.

Loan-to-value ratio

The loan-to-value ratio (LTV), often expressed as a percentage, measures the portion of capital borrowed relative to the total financing of a real estate project. In other words, it shows what fraction of the project is funded through debt compared to equity or personal funds.

While debt is not inherently negative—it can enable the realization of large-scale projects and speed up development—an excessive level can indicate vulnerability to changing market conditions or rising interest rates. Projects with a controlled LTV often have a more stable return potential, as they are less dependent on financing cost fluctuations. This can lead to more predictable returns for investors.

Every crowdlending project on our platform undergoes a rigorous financial analysis:

- We examine the capital structure of the project to ensure a healthy balance between debt and equity financing.

- We ensure that the project has a debt-to-equity ratio that reflects prudent financial management and a measured approach to leveraging.

- We present this information transparently, allowing you to make informed investment decisions based on solid and reliable data.

Borrower’s experience

The borrower’s experience is built on their project history and previous management of financial responsibilities. This includes their commitment to meeting repayment schedules, the quality of completed projects, and their responsiveness to market challenges.

Investing in projects led by borrowers with a proven track record can significantly reduce the inherent risk of the investment. A solid track record often signifies tested expertise and a deep understanding of the market.

Interest payment terms

The interest payment terms define how and when interest is paid out, affecting your liquidity.

Some crowdlending projects offer annual interest payments, meaning you will receive a portion of the interest generated by your investment once a year until the loan matures.

Other projects might choose a bullet payment approach, where the accumulated interest over the loan’s duration is paid out in a single lump sum at the end of the loan period.

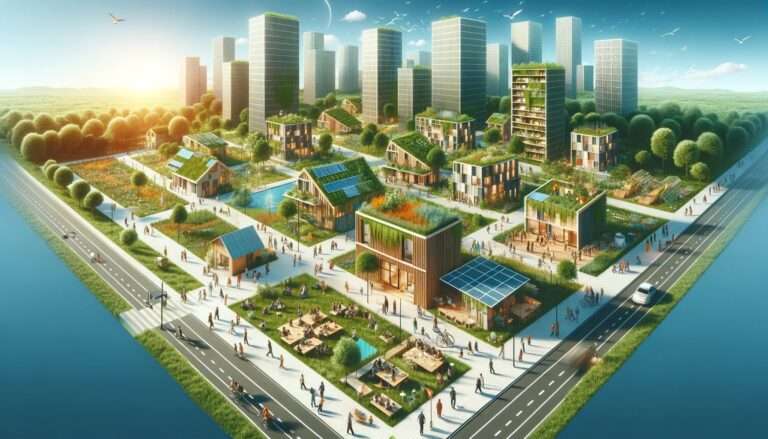

Ecological and Social Commitment in Real Estate Crowdlending

In an era where responsible investing continues to rise in significance, ecological and social criteria are becoming crucial factors in capital allocation decisions. Choosing to invest in projects that promote environmental sustainability or have a positive social impact allows investors to contribute to a better future while pursuing their financial goals.

Real estate projects focusing on energy efficiency, the use of sustainable materials, the conservation of natural resources, and the minimization of carbon footprints represent investments that are mindful of the environment and the well-being of future generations.

At Foxstone, we are aware of this shift in awareness and are committed to meeting the growing demand for investments that are not only financially sound but also align with the personal values of our investors.

Selection process and Guarantees

At Foxstone, security and trust form the cornerstone of our relationship with investors. This begins with a rigorous selection process that ensures only the most viable projects are presented to our members. To bolster this security, each project is structured with robust protective measures designed to safeguard your investment, including:

- Mortgage note: This legal security is anchored in the property itself. In the event of a payment default, the mortgage note grants Foxstone the right to claim the owed amount based on the value of the financed property.

- Holding company guarantee: This guarantee is a commitment by the borrower’s parent company (the holding) to cover the loan repayments. It thereby extends responsibility beyond the specific project entity, adding an extra layer of safety.

- Personal guarantee: A promise made by an individual, often one of the main shareholders or executives of the borrowing company, who commits his assets or guarantees for the loan repayment.

- Purchase option: As a last resort, if a project encounters insurmountable difficulties, Foxstone holds the option to purchase the concerned property. This not only protects the investors’ interests but also provides a means to recover the invested funds.

For each project featured on our platform, the details of protections and guarantees are explicitly stated. This allows investors to fully appreciate the extent of measures in place to safeguard their interests. We commit to maintaining complete transparency so you can invest with the assurance that every aspect of your commitment has been thoroughly vetted and secured.

Risk matrix

The relationship between return and risk isn’t left to chance. We’ve developed a sophisticated risk matrix that incorporates all the aforementioned elements and more. Thus, each project undergoes a rigorous evaluation that assesses financial, operational, and market risks. Following this evaluation, an interest rate is meticulously calculated to reflect the project’s overall risk profile.

We aim to strike a fair and equitable balance between compensation and risk, ensuring that you invest with confidence that the interest rate you receive is justified and aligned with the specific nature of your investment.

Diversification

In real estate crowdlending, diversification means allocating capital across multiple projects instead of just one. The concept is straightforward: if one project runs into trouble, the overall performance of your portfolio is less impacted because other investments can compensate or soften the losses.

With Foxstone, diversification is not just possible; it’s made easy. Investors have access to a variety of real estate projects, including new constructions, renovations, residential properties, commercial spaces, and more, each with its unique features and potential returns. The investment threshold of CHF 10’000 allows for spreading investments across multiple projects.

Conclusion

Navigating the realm of real estate crowdlending requires discernment and access to reliable information. Through its innovative and user-friendly platform, Foxstone offers investors a streamlined and secure way to diversify their real estate portfolio. By focusing on careful project selection, based on thorough risk assessment and solid guarantees, Foxstone enables confident investment in the real estate sector.

The platform promotes effective diversification across a broad spectrum of real estate projects, with accessible investment thresholds, making real estate crowdlending available to a wider audience. Transparency about the projects presented helps investors make informed decisions, aligned with their financial goals and personal values.

Foxstone democratizes access to real estate crowdlending, providing the necessary tools and information for well-informed decision-making. It’s an opportunity for investors to engage in carefully selected real estate projects while managing risk and targeting attractive returns.