The different real estate investment strategies

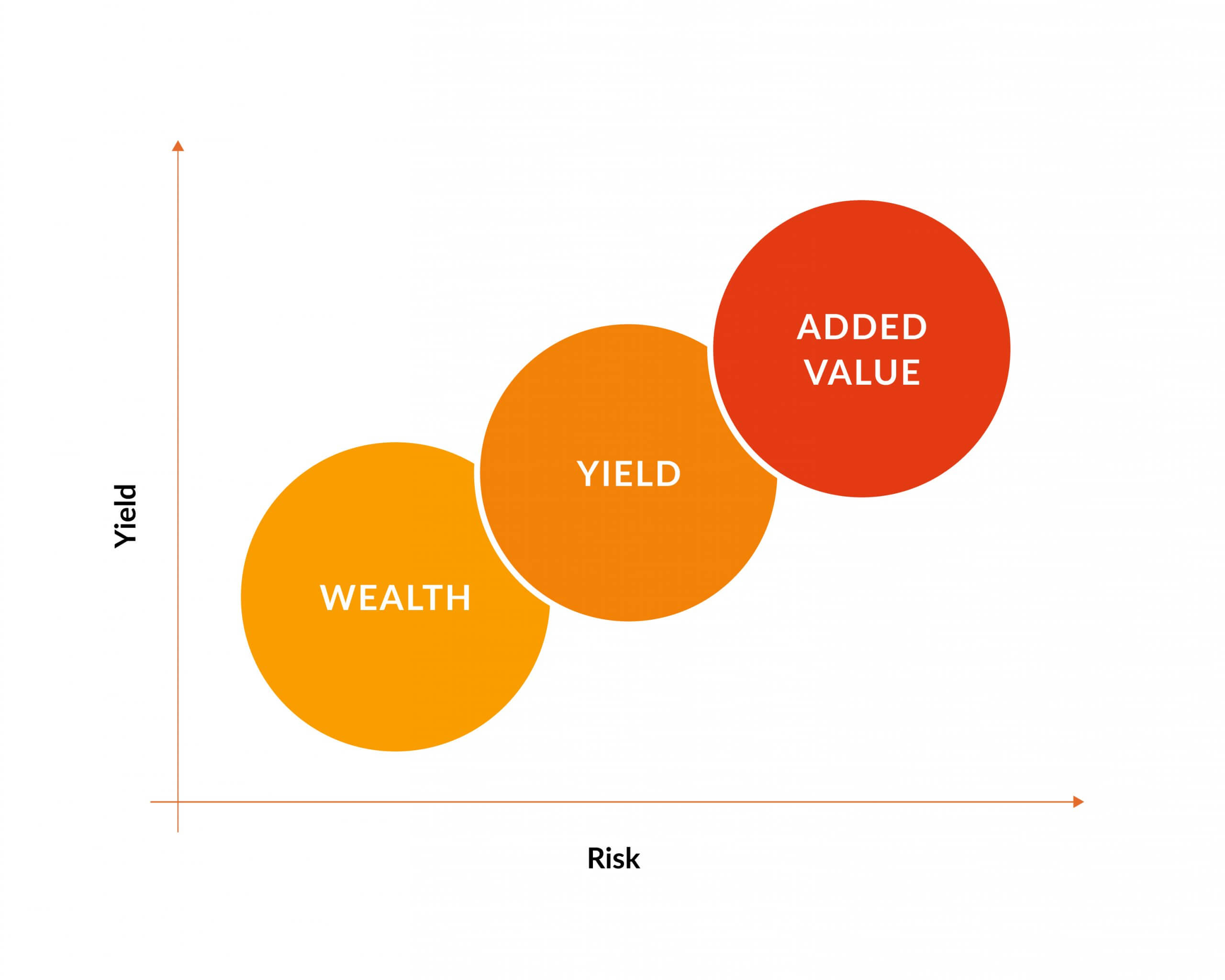

We present here the different real estate investment strategies offered by Foxstone. Understanding these different strategies is essential in order to choose the investment that best suits your risk profile, your investment horizon and your return objective. It is important to remember that in any investment, the return is often correlated to the risk taken.

The main criteria for differentiating these types of investments according to the properties are :

- The location of the property, which can be in a major city or on the outskirts with higher or lower occupancy rates (macro-location) as well as its proximity to amenities (micro-location) and the mobility offered (public transport, proximity to road and rail routes),

- The tenants according to their level of income, their solvency, the duration of the leases (long-term leases ensuring income stability) and their turnover rate,

- The condition of the building according to its stage in the renovation cycle,

- The investment horizon which varies from medium to long term,

- The sources of yield which can be mainly based on rental income or on the appreciation of the value of the asset in relation to the evolution of the real estate market.

Foxstone identifies three investment strategies:

- Wealth investing

- Yield investment

- Value-added investment

The wealth investment

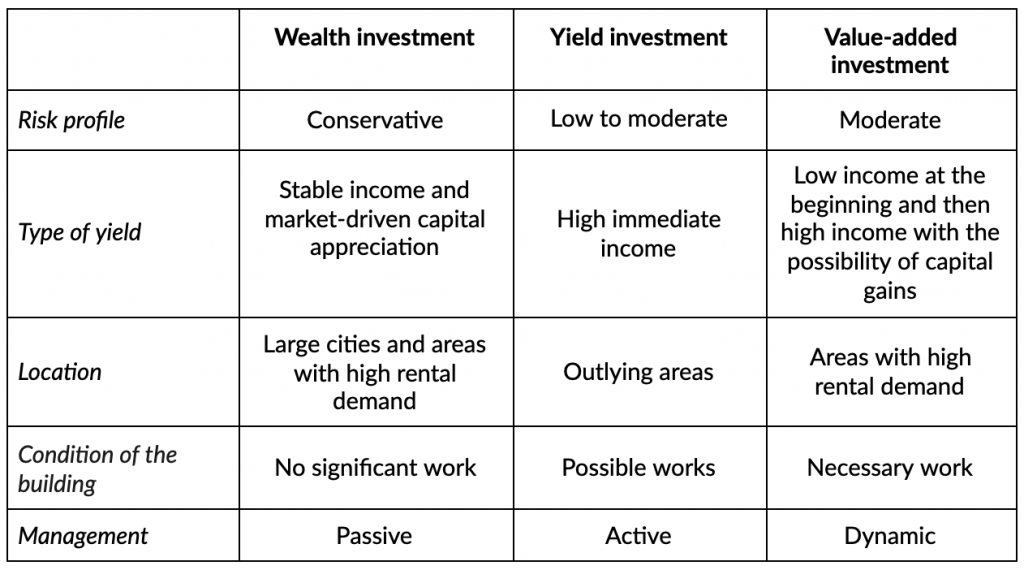

Risk profile: conservative

Strategy: Low risk with stable income and long-term capital appreciation

These are investments in properties with a low yield but located in a city or area with a very low risk of vacancy, such as Lausanne or Geneva. A well-placed property in a large city, close to amenities, does not remain empty for very long.

This type of investment targets buildings in which there is no significant work to be done and located in areas where there is a scarcity of land. They are generally occupied by high-income tenants with rents in the upper end of the market.

Properties in this investment category generate stable and consistent income. They are acquired with a long-term view and with the goal of generating a highly secure return with minimal asset management. They are very low risk investments with a high probability of long-term capital appreciation.

Asset-based real estate investments are highly sought after, especially by institutional investors such as pension funds who hold them as an alternative to bonds. This high demand creates strong price pressure, which inevitably lowers the yield.

Example of a patrimonial investment

The yield investment

Risk profile: Low to moderate

Strategy: High immediate return but less secure over the long term.

It is an investment whose purpose is to receive an immediate income.

The properties sought are often located in peripheral areas. Work is possible and it may be possible to increase the yield of certain buildings with minor improvements or efficient management.

This is a real estate investment that provides short-term income, but the income is less predictable than with an asset-based investment (when an apartment is vacant, it may take longer to re-rent) and the properties require more active management.

Example of a yield investment: Concise

Value-added investment

Risk profile: Moderate

Strategy: Higher risk taking with a low initial yield for a high yield in the medium to long term and a potential capital gain at resale.

A value-added investment yields low returns at the time of acquisition, but has the potential to produce significant returns once value has been added through a value-added strategy. The value-added opportunity lies in the investor clearly identifying the path to improvement and effectively making the necessary changes.

Value-added assets typically have vacancy (often related to obsolescence) and require work or improvements due to technical obsolescence or maintenance items that were ignored or neglected by the previous owner. The work performed will generally increase the net income of the property and investors will be able to capture this value appreciation upon resale, while accepting a moderate fee prior to the creation of this added value. Examples of value-adding work include: apartment renovations, typology changes to create more units, elevations, installation of green energy equipment, etc.

Foxstone has not yet offered any buildings in this category but will soon offer some on its platform.

The following table compares the three strategies :

The leverage effect, i.e. the level of debt in relation to equity, used at the time of the acquisition of the building is also one of the elements determining the level of risk of the operation. The higher the level of debt, the higher the financial risk of an operation. In Switzerland, the debt ratio on residential properties can generally reach 75% of the value of the property. For reasons of financial stability of the investment and anticipation of future interest rate increases, Foxstone generally prefers to borrow between 50% and 60% of the value of the property, so that the building is self-supporting and the mortgage charge is largely covered by the rental yield.

In any investment, the return varies according to the risk taken. Investors looking for income stability should choose patrimonial investments, those looking for immediate income should choose yield investments and those with a higher risk appetite should choose value-added investments. Finally, it is wise to create a diversified portfolio of properties from these three different categories; there is an individual strategy for each investor based on his or her risk and return expectations.