Complementarity of the loan and the participative investment

Crowdlending, which consists in gathering investors who lend funds to a development company in order to realize a real estate development project, is complementary in many ways to the participatory investment proposed for several years by Foxstone and which, as a reminder, consists in gathering investors who become co-owners of an existing and already rented building.

Crowdlending is an indirect participation, in the form of a loan, which yields a fixed income, whereas the participatory investment is a form of direct participation which yields recurring income with a possibility of capital appreciation over the long term.

The participative investment has a medium to long term horizon, whereas the participative loan, whose duration varies from 12 to 36 months, is adapted to a short term investment. It allows to reduce the average duration of the investments of a real estate portfolio and thus to ensure more liquidity.

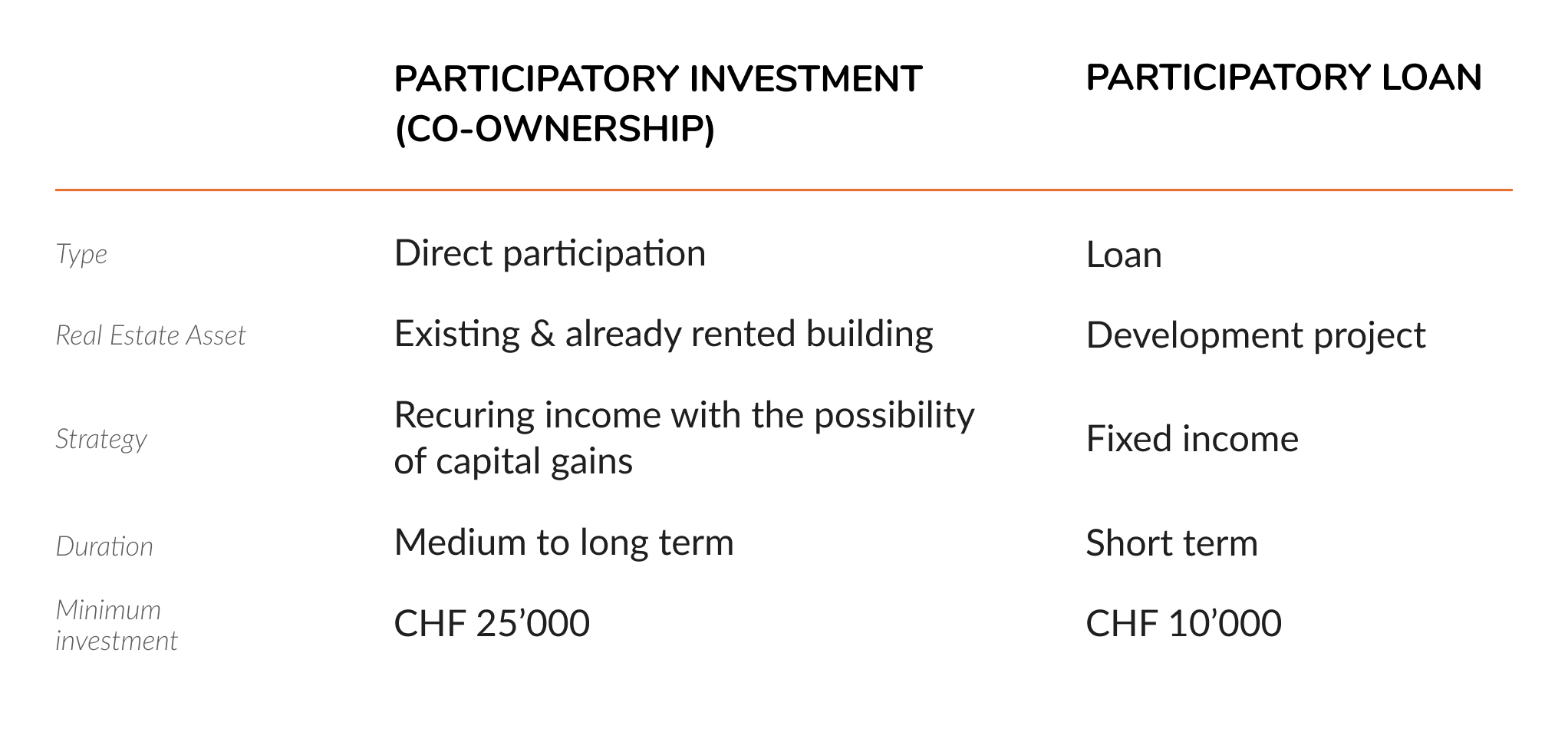

The table below summarizes the key differences between the two business models:

Crowdlending combined with participatory investment therefore allows for the creation of a diversified real estate portfolio with direct investments in existing properties and indirect investments in development projects.