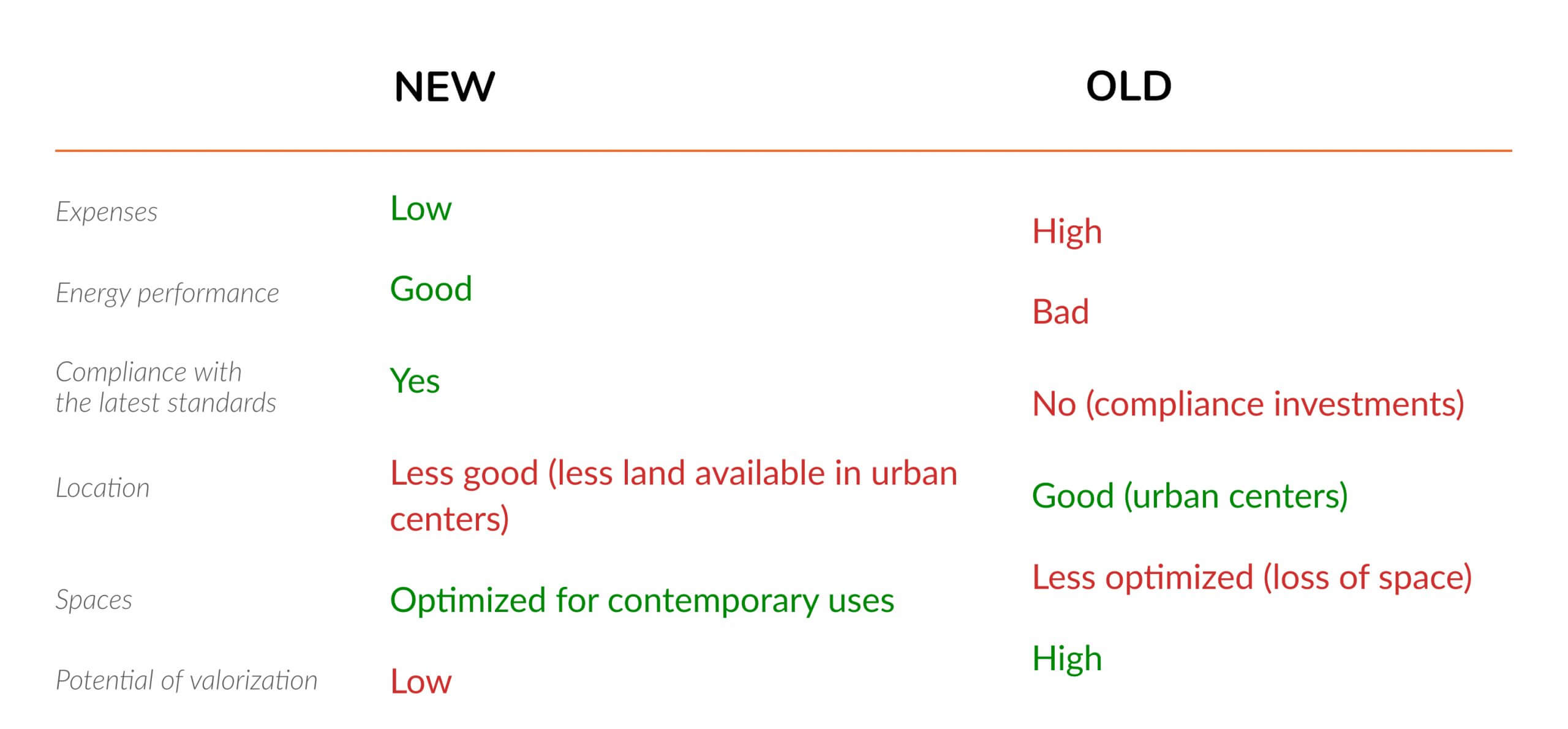

Advantages and disadvantages of investing in a new property

You wish to invest in real estate and you hesitate between a new building and an older one. There is no easy answer as to which one is the best investment. There are several factors to consider depending on your investment strategy and your real estate portfolio. Here are some things to think about to help you compare these two types of properties and decide which one is right for you.

New construction provides greater peace of mind for your investment

New construction ensures that the property will not require much maintenance for the next ten years or more, as long as the building has been well designed. The owner is assured of not having to do too much maintenance or renovation work in the more or less long term.

On the other hand, by investing in an old building, one must be ready to carry out renovation work and to devote time to it. As a result, condominium fees are higher in older buildings and this difference tends to increase over time. For two buildings with similar locations, the return on old buildings is less assured than that of new buildings.

For old buildings, Foxstone budgets the work to be done in the next ten years based on the technical audit carried out by the independent expert. Then, according to the budget established, a portion of the rents is set aside in a renovation fund in order to carry out the work that will allow the building to be enhanced or maintain its value over the long term.

Because of the relative tranquility that new buildings provide compared to old ones, they are better suited to a passive investment strategy.

The new building meets energy and environmental standards

New buildings generally meet the latest environmental and energy standards and therefore offer savings on energy bills. This further reduces the total costs of new construction compared to old construction, as energy consumption is usually one of the largest costs in a building.

In 2019, the Federal Council set the goal of reducing climate-damaging greenhouse gas emissions to net zero by 2050. In order to meet this challenge, the building sector will have to significantly reduce its emissions and many older buildings will require extensive retrofitting. A new property does not face this problem as it meets current and even future standards.

New construction is more attractive to tenants

In general, new housing is perceived to be of higher quality. This makes them more attractive to tenants who are looking for modern facilities and amenities and are willing to pay a higher rent. This ability to attract quality tenants can reduce the risk of vacancy.

Fewer new properties in major centers

In terms of location, one of the most important criteria when investing in real estate, old buildings offer better opportunities in large urban centers, where everything is already built. New buildings are often more out of the way.

Buildings located in large urban centers have a high rental demand due to their proximity to infrastructure, which limits the risk of vacancy compared to a more remote property.

However, with the development of telecommuting over the past two years, proximity to the workplace is becoming less important and people are looking more for new properties with larger living areas. The municipalities on the outskirts of urban centers in which new buildings are built are therefore becoming more attractive.

New buildings have less potential for improvement

The main advantage of older properties compared to new ones is that they can be improved through value enhancement strategies. A cosmetic makeover can improve the value, profitability and rental yield of an older property; something that is not possible with a new property. Older properties therefore have a greater potential for value enhancement than new properties.

All in all, both new and old properties have their advantages and disadvantages. The choice between one or the other will depend mainly on the investor’s profile, the strategy he wishes to adopt and the time he is ready to devote to his investment.